In 2020 e-Commerce subscription sales bloomed, with 41% growth in 2020 according to eMarketer estimates. The trend is here to stay, a survey conducted by GFK showed that 23% of Americans said they are trying and are likely to continue shopping via subscription services.

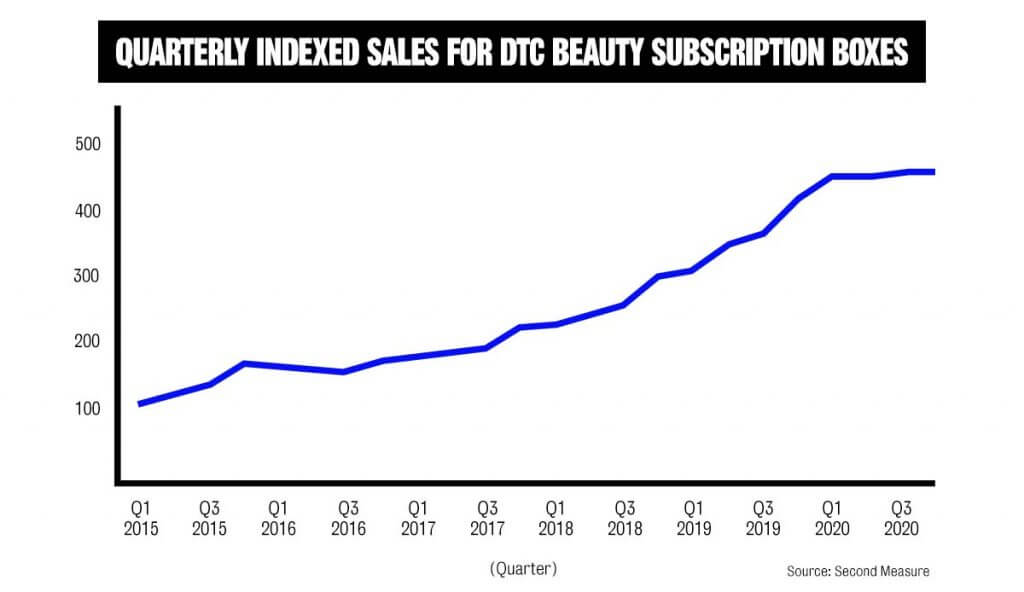

Turning to beauty specifically, at the start of the pandemic some beauty subscription services saw cancellations. However, thanks to consumers deciding to dedicate time to self-care and adopting new beauty regimes, overall, beauty box sales remain high. For example, since 2015, the total sales of the major players in the beauty subscription sector have more than quadrupled reflecting the continued adoption of beauty subscriptions and beauty boxes increasingly becoming an integral part of the American consumers’ self-care routine.

Beauty Consumers

According to GWI, the size of the beauty audience in the US is approx. 57.6 million (GWI Q3 2021). At 79% female, the audience is still largely feminine, however, there is notable growth amongst male consumers, with male beauty fans increasing to 21% in Q3 2021, increasing from 14.9% in Q3 2019.

Top cosmetic products are mascara, eyeliner, and make-up remover, with top skincare products including hand cream, body moisturizer, and facial cleanser.

Purchase factors

Customers are looking for quality, price, brand, chemical-free/natural ingredients, customer reviews, and cruelty-free factors. In 2021 consumers were buying products that improve skin condition, use SPF, are vitamin-infused, or help simplify their routines.

Unsurprisingly, word of mouth, social media, and entertainment & music streaming services are all channels where beauty consumers spend significant amounts of time. On average, beauty consumers spend 2.34 hours per day on social media, just over 2 hours a day on music streaming services, and TV streaming also coming in at an average of 2 hours a day.

Beauty Subscription Services

The majority of website visitors are Gen Z and millennials, with 53% of visitors between the ages of 18-34. A huge 88% of traffic comes from mobile web, so having a slick mobile presence and customer journey is a must for brands. Despite significant time spent on social channels by beauty audiences, under 2% of traffic comes from social channels, with the vast majority, 61% driven direct.

According to Statista, consumers who are interested in beauty box services are driven by the discovery of new products (52%), followed by receiving high-quality products (35%). At 48%, most potential female subscribers believe a monthly delivery is the right frequency, but there are 26% of potential customers who would prefer a delivery frequency of up to twice a month.

In terms of the number of items in a box, 45% of subscribers are looking for 4-5 items in a beauty box, 28% would prefer 6-7 items in a box and 48% are looking for an equal mix of sample & full-size products. In 2020, American personal care & beauty subscribers are spending $34 a month on subscription boxes.

Trends to be aware of

Vegan shoppers

The US is seeing the fastest growth in vegan cosmetics in the world, driven by general consumer awareness and increasing demand from mainstream consumers for vegan-certified products. Similarly, non-toxic and cruelty-free products are amongst the top purchase factors for personal care products and beauty shoppers in the US.

Male beauty shoppers

Male interest in beauty/cosmetics boomed during the pandemic, the percentage share of US males interested in beauty/cosmetics has grown from 14.9% in Q3 2019 to 21% in Q3 2021. Forecast to reach $166 billion by 2022, the men’s personal care market represents a huge opportunity for brands. The overlap between grooming and wellness needs means new self-care routines are emerging.

Inclusive beauty

According to Mintel, American beauty shoppers are seeking inclusion, with 63% of Americas saying they are inspired by brands that show diversity in advertising. Almost half of beauty consumers, 47%, say they have looked for/bought from brands with diversity or inclusivity in the last year and a quarter, 24% have shopped with beauty brands that are minority-owned.

Contact us to find out more, us@mcsaatchiperformance.com.